Tax Quotes (38 quotes)

Taxes Quotes

Taxes Quotes

[In] death at least there would be one profit; it would no longer be necessary to eat, to drink, to pay taxes, or to [offend] others; and as a man lies in his grave not one year, but hundreds and thousands of years, the profit was enormous. The life of man was, in short, a loss, and only his death a profit.

In short story, Rothschild’s Fiddle (1894). Collected in The Black Monk and Other Stories (1915), 138.

[The body of law] has taxed the deliberative spirit of ages. The great minds of the earth have done it homage. It was the fruit of experience. Under it men prospered, all the arts flourished, and society stood firm. Every right and duty could be understood because the rules regulating each had their foundation in reason, in the nature and fitness of things; were adapted to the wants of our race, were addressed to the mind and to the heart; were like so many scraps of logic articulate with demonstration. Legislation, it is true occasionally lent its aid, but not in the pride of opinion, not by devising schemes inexpedient and untried, but in a deferential spirit, as a subordinate co-worker.

From biographical preface by T. Bigelow to Austin Abbott (ed.), Official Report of the Trial of Henry Ward Beecher (1875), Vol. 1, xii.

If the Indians hadn’t spent the $24. In 1626 Peter Minuit, first governor of New Netherland, purchased Manhattan Island from the Indians for about $24. … Assume for simplicity a uniform rate of 7% from 1626 to the present, and suppose that the Indians had put their $24 at [compound] interest at that rate …. What would be the amount now, after 280 years? 24 x 1.07²⁸⁰ = more than 4,042,000,000.

The latest tax assessment available at the time of writing gives the realty for the borough of Manhattan as $3,820,754,181. This is estimated to be 78% of the actual value, making the actual value a little more than $4,898,400,000.

The amount of the Indians’ money would therefore be more than the present assessed valuation but less than the actual valuation.

The latest tax assessment available at the time of writing gives the realty for the borough of Manhattan as $3,820,754,181. This is estimated to be 78% of the actual value, making the actual value a little more than $4,898,400,000.

The amount of the Indians’ money would therefore be more than the present assessed valuation but less than the actual valuation.

In A Scrap-book of Elementary Mathematics: Notes, Recreations, Essays (1908), 47-48.

Le mur murant Paris rend Paris murmurant.

The wall surrounding Paris is making Paris grumble.

Parisian saying after the Farmers-General of taxes, acting on a proposal by Lavoisier, erected a customs wall around Paris.

The wall surrounding Paris is making Paris grumble.

Parisian saying after the Farmers-General of taxes, acting on a proposal by Lavoisier, erected a customs wall around Paris.

Quoted in D. McKie, Antoine Lavoisier: Scientist, Economist, Social Reformer (1952), 136.

A tax on the farms would then result in the proprietors themselves working the lands, and this would mean better cultivation, and improvements which would yield returns indeed, but at too remote a period for the tenant. It would tend to a division of landed property, men of small fortune uniting in the purchase with capitalists who seek only the rent or payment for the land.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 212-213.

A tax on the rent of a farm would be much better than a tax on the land itself. Proprietors then could only avoid taxes by themselves improving their property. As it is, they merely collect the rents, and usually employ their surplus in unproductive expenditure, while the proprietary farmers voluntarily devote theirs to the improvement of the land.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 212.

And as long as industrial systems have bowels

The boss should reside in the nest that he fouls.

Economists argue that all the world lacks is

A suitable system of effluent taxes.

The boss should reside in the nest that he fouls.

Economists argue that all the world lacks is

A suitable system of effluent taxes.

In Kenneth Ewart Boulding and Richard P. Beilock (Ed.), Illustrating Economics: Beasts, Ballads and Aphorisms (1980, 2009), 3.

Finally, in regard to those who possess the largest shares in the stock of worldly goods, could there, in your opinion, be any police so vigilant and effetive, for the protections of all the rights of person, property and character, as such a sound and comprehensive education and training, as our system of Common Schools could be made to impart; and would not the payment of a sufficient tax to make such education and training universal, be the cheapest means of self-protection and insurance?

Annual Reports of the Secretary of the Board of Education of Massachusetts for the years 1839-1844, Life and Works of Horace Mann (1891), Vol. 3, 100.

Higher energy prices act like a tax. They reduce the disposable income people have available for other things.

From response to a question about the effect on the economy of rising oil and gasoline prices. In transcript, 'Treasury Secretary Snow Optimistic on Economy', PBS Newshour (23 Mar 2005), on pbs.org website.

I suspect that the most important effect of World War II on physical science lay in the change in the attitude of people to science. The politicians and the public were convinced that science was useful and were in no position to argue about the details. A professor of physics might be more sinister than he was in the 1930s, but he was no longer an old fool with a beard in a comic-strip. The scientists or at any rate the physicists, had changed their attitude. They not only believed in the interest of science for themselves, they had acquired also a belief that the tax-payer should and would pay for it and would, in some unspecified length of run, benefit by it.

'The Effect of World War II on the Development of Knowledge in the Physical Sciences', Proceedings of the Royal Society of London, 1975, Series A, 342, 532.

In India we have clear evidence that administrative statistics had reached a high state of organization before 300 B.C. In the Arthasastra of Kautilya … the duties of the Gopa, the village accountant, [include] “by setting up boundaries to villages, by numbering plots of grounds as cultivated, uncultivated, plains, wet lands, gardens, vegetable gardens, fences (váta), forests altars, temples of gods, irrigation works, cremation grounds, feeding houses (sattra), places where water is freely supplied to travellers (prapá), places of pilgrimage, pasture grounds and roads, and thereby fixing the boundaries of various villages, of fields, of forests, and of roads, he shall register gifts, sales, charities, and remission of taxes regarding fields.”

Editorial, introducing the new statistics journal of the Indian Statistical Institute, Sankhayā (1933), 1, No. 1. Also reprinted in Sankhyā: The Indian Journal of Statistics (Feb 2003), 65, No. 1, viii.

In Institutions of a lower grade [secondary schools], it [geology] receives far less attention than its merits deserve. Why should not a science, whose facts possess a thrilling interest; whose reasonings are admirably adapted for mental discipline, and often severely tax the strongest powers; and whose results are, many of them, as grand and ennobling as those of Astronomy itself; … why should not such a science be thought as essential in education as the kindred branches of Chemistry and Astronomy?

In 'Preface', Elementary Geology (1840, 1841), vi.

It is quite possible that mathematics was invented in the ancient Middle East to keep track of tax receipts and grain stores. How odd that out of this should come a subtle scientific language that can effectively describe and predict the most arcane aspects of the Universe.

Epigraph in Isaac Asimov’s Book of Science and Nature Quotations (1988), 265.

Like taxes, radioactivity has long been with us and in increasing amounts; it is not to be hated and feared, but accepted and controlled. Radiation is dangerous, let there be no mistake about that—but the modern world abounds in dangerous substances and situations too numerous to mention. ... Consider radiation as something to be treated with respect, avoided when practicable, and accepted when inevitable.

Recommending the same view towards radiation as the risks of automobile travel.

Recommending the same view towards radiation as the risks of automobile travel.

While in the Office of Naval Research. In Must we Hide? (1949), 44.

Making out an income tax is a lesson in mathematics: addition, division, multiplication and extraction.

In Evan Esar, 20,000 Quips and Quotes, 419.

Now it is by a fiction that the purchaser pays the mutation tax. In fact, it is always the seller who pays it. The buyer compares the money that he spends with the advantage that he gains, and this comparison determines it. If he did not make money out of it he would not buy it. When the registration tax did not exist, the purchaser had to pay the same sum for the same purpose, and this sum went into the pocket of the seller.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 214-215.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archaeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

From Address (1940), given at the Bicentennial Conference at the University of Pennsylvania, 'The Mathematical Way of Thinking'. Collected in Hermann Weyl and Peter Pesic (ed.), Levels of Infinity: Selected Writings on Mathematics and Philosophy (2012), 67.

Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.

Letter to Jean Baptiste Le Roy, 13 Nov 1789. Quoted in Albert Henry Smyth (ed.) The Writings of Benjamin Franklin (1907), vol. 10, 69.

Perhaps it would be necessary to weaken their opposition by not subjecting the actual proprietors to the new tax, which might take effect only with the next change either by sale or by inheritance. A restriction of the right of transfer would also facilitate the passage from one situation to the other. All changes in taxes should, as a general thing, be made gradually, in order to avoid sudden changes of fortune.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 214.

Proprietors of lands, then, after all, have to bear the mutation taxes. All increase of these taxes is a loss for them, and these taxes are heavier on the small proprietors than on the large, because their changes are more frequent. The tax on the farms, on the contrary, would bear more heavily on large estates.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 215.

Proprietors, becoming cultivators to escape the taxes, would settle in the country, where their presence would disseminate intelligence and comfort; their revenues, before spent unprofitably, would then pay expenses and improvements on their property.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 213.

Science has increased our lifespan considerably. Now we can look forward to paying our taxes at least ten years longer.

In E.C. McKenzie, 14,000 Quips and Quotes for Speakers, Writers, Editors, Preachers, and Teachers (1990), 496.

Taxes are a means of influencing production and commerce to give to them a direction which they would not naturally have taken. Such an influence may undoubtedly have disagreeable consequences if the taxes are imposed without discrimination or exclusively for a fiscal purpose, but it is entirely otherwise if wisdom and tact preside at their institution.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 212.

Taxes are regarded by economists as an evil, but as a necessary evil, since they provide for public expenses. Consequently, economists think that if the government possessed sufficient revenues, in domains for example, the suppression of all taxes would be a desirable measure.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 212.

The Eiffel Tower is the Empire State Building after taxes.

The establishment of such a tax would certainly find many opponents among proprietors, landed non-cultivators who form in fact the influential personnel in the state, for it is they who usually make the laws

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 213-214.

The hardest thing to understand in the world is the income tax.

…...

The individual on his own is stable only so long as he is possessed of self-esteem. The maintenance of self-esteem is a continuous task which taxes all of the individual’s powers and inner resources. We have to prove our worth and justify our existence anew each day. When, for whatever reason, self-esteem is unattainable, the autonomous individual becomes a highly explosive entity. He turns away from an unpromising self and plunges into the pursuit of pride—the explosive substitute for self-esteem. All social disturbances and upheavals have their roots in crises of individual self-esteem, and the great endeavor in which the masses most readily unite is basically a search for pride.

In The Passionate State of Mind (1955), 18

The tax on farms not affecting the owners of timber, would be made up by a tax on the felling, a very justifiable tax, for standing timber is landed property. Standing timber is often worth much more than the land on which it stands.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 215.

There are those who say we cannot afford to invest in science, that support for research is somehow a luxury at moments defined by necessities. I fundamentally disagree. Science is more essential for our prosperity, our security, our health, our environment, and our quality of life than it has ever been before. … we can't allow our nation to fall behind. Unfortunately, that's exactly what's happened. Federal funding in the physical sciences as a portion of our gross domestic product has fallen by nearly half over the past quarter century. Time and again we've allowed the research and experimentation tax credit, which helps businesses grow and innovate, to lapse.

Speech to the National Academy of Sciences Annual Meeting (27 Apr 2009).

There is just one thing I can promise you about the outer-space program: Your tax dollar will go farther.

Attributed in Reader's Digest (1961). In Fred R. Shapiro, The Yale Book of Quotations (2006), 101.

Thinking is one thing no one has ever been able to tax.

This king [Sesostris] divided the land among all Egyptians so as to give each one a quadrangle of equal size and to draw from each his revenues, by imposing a tax to be levied yearly. But everyone from whose part the river tore anything away, had to go to him to notify what had happened; he then sent overseers who had to measure out how much the land had become smaller, in order that the owner might pay on what was left, in proportion to the entire tax imposed. In this way, it appears to me, geometry originated, which passed thence to Hellas.

(II. c. 109) As quoted in Florian Cajori, A History of Elementary Mathematics (1893), 10, footnoted to C.A. Bretschneider, Die Geometrie und die Geometer vor Eukides (1870). Note that the word geometry itself means “land measurement.”

Water at command, by turning a tap and paying a tax, is more convenient than carrying it from a free spring.

In Sinner Sermons: A Selection of the Best Paragraphs of E. W. Howe (1926), 49.

We claim to be more moral than other nations, and to conquer and govern and tax and plunder weaker peoples for their good! While robbing them we actually claim to be benefactors! And then we wonder, or profess to wonder, why other Governments hate us! Are they not fully justified in hating us? Is it surprising that they seek every means to annoy us, that they struggle to get navies to compete with us, and look forward to a time when some two or three of them may combine together and thoroughly humble and cripple us? And who can deny that any just Being, looking at all the nations of the earth with impartiality and thorough knowledge, would decide that we deserve to be humbled, and that it might do us good?

In 'Practical Politics', The Clarion (30 Sep 1904), 1.

We may consider the renting of a property for several years as a sale of the usufruct during the time of the lease. Now nine years' possession, for example, is equal to more than a third of the value of the property, supposing the annual product to be one twentieth of the capital. It would then be reasonable to apply to this sort of sale the laws which govern that of landed property, and consequently the mutation tax. The person who cannot or will not cultivate his soil, instead of alienating the property itself, binds himself to alienate the usufruct for a time, and the price is paid at stated intervals instead of all at once. There is farm rent.

From Appendix A, 'Extracts From the Unpublished Writings of Carnot', Reflections on the Motive Power of Heat (1890, 2nd ed. 1897), 214.

Weeds function as an unseen tax on the crop harvest.

From 'War on Weeds', Science (19 Apr 1946), 103, No. 2677, 465.

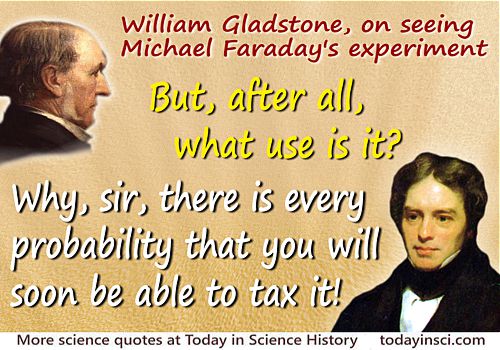

Why, sir, there is every probability that you will soon be able to tax it!

Said to William Gladstone, the Chancellor of the Exchequer, when he asked about the practical worth of electricity.

Said to William Gladstone, the Chancellor of the Exchequer, when he asked about the practical worth of electricity.

Quoted in R. A. Gregory, Discovery, Or The Spirit and Service of Science (1916), 3.

In science it often happens that scientists say, 'You know that's a really good argument; my position is mistaken,' and then they would actually change their minds and you never hear that old view from them again. They really do it. It doesn't happen as often as it should, because scientists are human and change is sometimes painful. But it happens every day. I cannot recall the last time something like that happened in politics or religion.

(1987) --

In science it often happens that scientists say, 'You know that's a really good argument; my position is mistaken,' and then they would actually change their minds and you never hear that old view from them again. They really do it. It doesn't happen as often as it should, because scientists are human and change is sometimes painful. But it happens every day. I cannot recall the last time something like that happened in politics or religion.

(1987) --